Filing a construction lien can protect contractors and property owners when payment issues threaten hard-earned project revenue. Knowing how to file a construction lien in Texas helps preserve payment rights while avoiding common errors and missed deadlines. This educational guide is written for contractors, subcontractors, suppliers, and property owners who need clarity through a complex legal process. Pro Elite Construction regularly works with Texas clients who value projects completed correctly while protecting financial and contractual interests.

The Construction Lien Eligibility in Texas

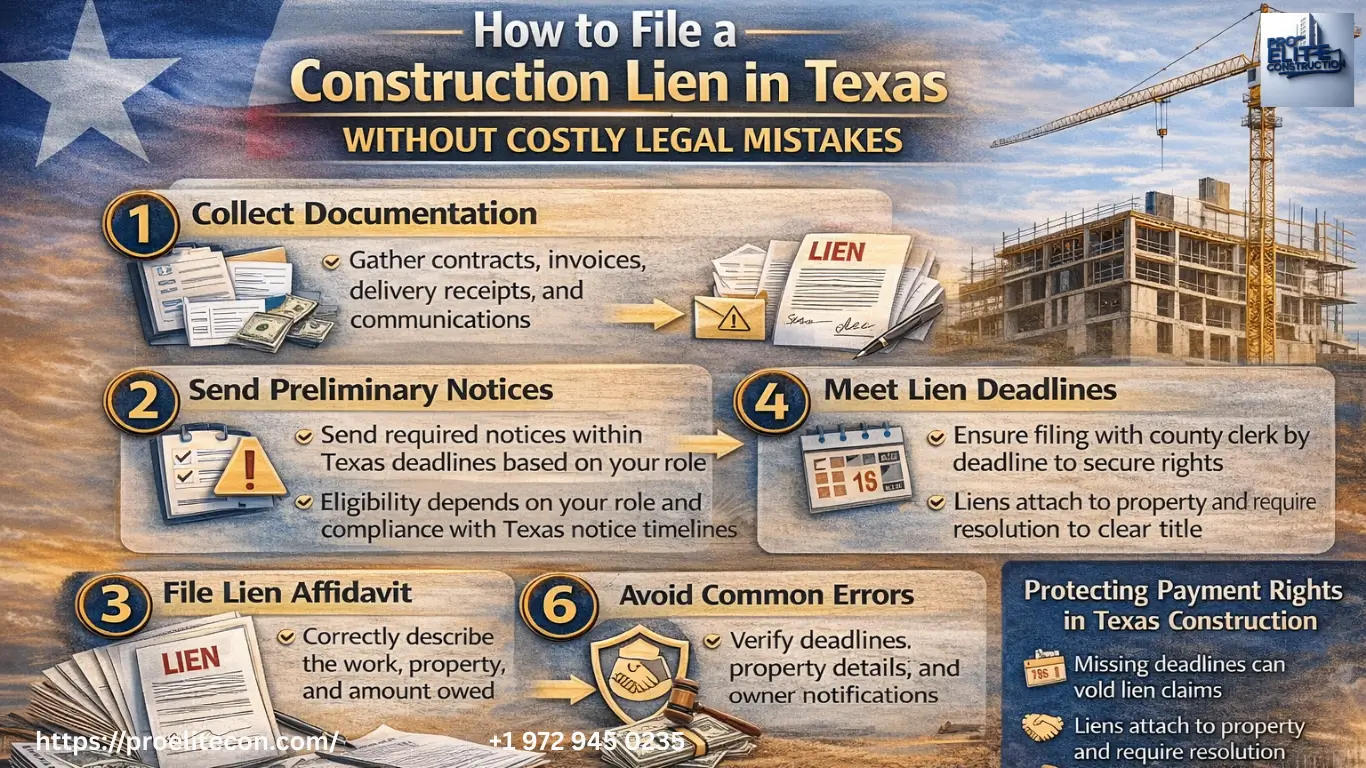

Learning how to file a construction lien in Texas begins with determining eligibility under Texas Property Code requirements. Contractors, subcontractors, and material suppliers may file liens when labor or materials were provided without proper payment. The process starts by gathering contracts, invoices, delivery receipts, and written communications that support the unpaid balance. Accurate documentation strengthens lien validity and reduces disputes during enforcement discussions. Required preliminary notices must be sent within strict timelines based on project type and contractor role. Texas enforces notice compliance rigidly, meaning one missed deadline can invalidate an entire claim. The lien affidavit must then describe the work performed, property details, and the unpaid amount precisely. Once prepared, it must be filed with the county clerk where the property is located. Contractors involved in residential construction in Allen often underestimate how quickly these deadlines approach after project completion, especially on fast-moving projects or new construction homes in Allen.

Protecting Payment Rights on how to file a construction lien in Texas

Knowing how to file a construction lien in Texas is essential for protecting payment rights in competitive construction markets. Construction liens help contractors and property owners manage risk when payment issues arise by providing legal protection tied directly to the property.

Key benefits of construction liens include:

- Creating legal leverage by attaching a claim directly to the improved property until payment is resolved

- Preserving recovery options when disputes escalate or owners delay payment indefinitely

- Strengthening negotiation power and encouraging faster resolution without immediate litigation

- Reducing disputes through clear documentation and formal communication processes

- Protecting contractors under Texas law when payment issues arise

- Helping property owners avoid title issues, refinancing delays, or complications during future property sales

- Managing complexity in commercial construction in Allen, where multiple stakeholders, lenders, and layered contracts increase lien risks complexity and documentation requirements.

Filing Before Texas Construction Lien Deadlines Pass

Knowing how to file a construction lien in Texas requires close attention to strict statutory deadlines. Texas lien timelines differ depending on residential or commercial classification and the filer’s role. Subcontractors and suppliers must typically send monthly notices by the fifteenth day of the following month. Original contractors usually must file liens by the fifteenth day of the fourth month after project completion. Missing these deadlines results in automatic loss of lien rights regardless of unpaid balances. Calendar tracking and disciplined processes are essential for financial stability. Many contractors reach out after deadlines pass seeking recovery options. Early planning and consultation prevent irreversible mistakes and protect cash flow, especially on commercial construction in Allen projects with extended timelines.

Handling Delayed or Disputed Payments

Late payments and disputes are common in construction, especially near project completion or when scope disagreements arise. Knowing how to file a construction lien in Texas gives contractors a structured way to respond when negotiations stall.

Recommended steps when payment is delayed or disputed:

- Begin with written demand notices that clearly outline balances owed and expected payment timelines

- Use clear, professional communication to resolve issues before escalating legal action

- File a construction lien if delays continue to preserve payment rights while negotiations remain open

- Take advantage of Texas law, which allows flexibility after lien filing without requiring immediate lawsuits

- Account for delays common in residential construction in Allen, including inspections, change orders, and financing approvals

- Protect contractors working on new construction homes in Allen from prolonged payment uncertainty

- Ensure liens are filed correctly so contractors are not unfairly burdened during extended project timelines

Avoiding Common Construction Lien Filing Errors

Many liens fail due to preventable mistakes rather than lack of entitlement. Learning how to file a construction lien in Texas correctly avoids rejection or later invalidation. Common errors include inaccurate property descriptions, missed notice deadlines, and incorrect claim amounts. Filing in the wrong county or failing to notify property owners also invalidates liens. Texas courts enforce lien statutes strictly, leaving little room for correction. Professional guidance reduces risk and legal exposure. Contractors should treat lien preparation with the same diligence as contract execution. Precision protects both reputations and legal rights. Pro Elite Construction emphasizes education and disciplined planning to help contractors avoid these pitfalls.

Residential vs Commercial Construction Liens in Texas

Lien rules differ significantly between residential and commercial projects, creating confusion for many contractors. Knowing how to file a construction lien in Texas requires correctly identifying project classification. Residential projects require additional disclosures designed to protect homeowners. Commercial projects allow more flexibility but involve higher values and complex contractual layers. Commercial construction in Allen frequently includes lenders, architects, and multiple subcontractor tiers. Each party must follow specific notice requirements to preserve lien rights. Misclassification leads to missed steps and invalid claims. Experienced professionals help navigate these differences efficiently and responsibly, particularly on mixed-use developments and new construction homes in Allen.

Guidance for First-Time Lien Filers

New contractors often feel overwhelmed by lien laws and procedures. Learning how to file a construction lien in Texas becomes manageable with clear guidance and preparation. Start by understanding your role on the project and applicable notice deadlines. Maintain organized records from project inception, including contracts and communications. Seeking professional advice before filing reduces costly mistakes. Education empowers contractors to protect income while maintaining ethical practices. Pro Elite Construction supports contractors through education, planning, and construction expertise across Texas markets. Knowledge-driven decisions build stronger businesses and long-term success.

Final Thoughts on Protecting Construction Payment Rights

Construction liens remain one of the most effective tools for securing unpaid balances in Texas. knowing how to file a construction lien in Texas protects contractors while encouraging fair project resolution. Whether managing residential construction in Allen, commercial construction in Allen, or new construction homes in Allen, proactive planning prevents disputes from escalating unnecessarily. Education, preparation, and professional support remain the foundation of successful lien execution.

Ready to Protect Your Construction Projects?

If you need guidance beyond this educational resource, Pro Elite Construction is here to help. Learn more about our experience and values by visiting about us. Have questions about your project or payment concerns? Reach out or contact us to this phone number 972 945 0235 to start a conversation. When clarity matters and timelines are tight, partner with professionals who understand construction from planning to protection.

Related Post:

New Construction Homes in Allen TX

Commercial Construction in Allen on Smart Building for Long-Term Success

Signs for Construction Sites in Allen TX for Common Compliance Mistakes

How to Choose the Right Construction Firm in Dallas for Your Project

New Construction Townhomes in Dallas

FAQ’s

1: Who is eligible to file a construction lien in Texas?

In Texas, original contractors, subcontractors, laborers, and material suppliers may file a construction lien if they provided labor or materials and were not paid. Eligibility depends on your role in the project and compliance with notice requirements under Texas Property Code. Both residential and commercial projects qualify, but the rules and deadlines vary.

2: What happens if I miss a construction lien deadline in Texas?

Missing a lien deadline usually results in the permanent loss of lien rights, regardless of the amount owed. Texas enforces strict timelines, and courts rarely allow exceptions. This is why early planning, accurate documentation, and understanding notice schedules are essential to protecting payment rights.

3: Can filing a construction lien stop a project sale or refinancing?

Yes. A properly filed construction lien attaches to the property title, which can